The dumbest possible means of transport is an annoying waste of money

Harleys are dumb — period.

There is nothing quite as tranquil as the morning. A natural early riser, I haven’t used an alarm clock in well over a decade and in the summer, there’s nothing better than waking up to the sounds of chirping birds and the smell of newly awakened sunshine carried to my sleeping face on a fresh breeze through the open window.

I’m fortunate to live in one of the most beautiful neighborhoods in one of the most beautiful cities in the U.S. Just below my home lies a dock welcoming the residents of nearby little Vashon Island via ferry.

Quite a few residents drive across on the ferry each day, lining up on one end and then the other to make their way to Seattle and beyond for jobs that help them pay for their island lifestyle. To keep costs down and to save time, many commute via motorcycle (two-wheeled transport and walk-ons don’t have to wait in the sometimes very long car line). When the ferry arrives at the dock, all the motorcycles get off before the cars, heading off into town in one long line.

It’s a pretty smart approach if you’re going to live on the island: why not save yourself some time and cost by switching to two wheels (assuming you’re willing to accept the inherent danger). If I lived over there, I’d consider it myself.

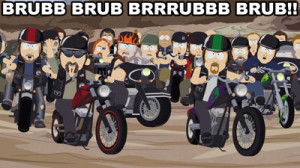

But there are always a few douchebags that spoil things. These are, as you’ve no doubt guessed, the Harley-Davidson riders.

At 5:42 a.m. each weekday, I”m awoken by the annoying growl of the world’s most ridiculous motorcycles.

These sociopathic gas-powered noise machines are increasingly a frustrating fact of life in most urban and suburban areas these days. For some reason, law enforcement seems to ignore noise ordinances even as these obnoxious machines take enjoyment away from our peaceable existence.

No noise, no crazed following

During our recent vacation to Maui, we stayed in a condo that turned out to be on a road that was a little louder than expected. The normal road noise, however, was tolerable for an affordable vacation getaway. The Harleys, however, were completely intolerable. There was a Harley-Davidson rental shop nearby and tourists fly in from around the country for cosplay on rented bikes. They vroom-vroom all over the island, certainly having a great time, never realizing or caring how many vacations they’re ruining in the process.

Not unlike the jerks that think it’s hilarious to trash the environment just to piss off people who care about it, the whole POINT of riding a Harley is to annoy people with noise. Without the noise, is it really a Harley?

Being a responsible corporate organization, Harley wouldn’t produce a vehicle that blatantly scoffed at noise laws. It leaves the job to third-party manufacturers so you can customize your hog to be even more annoying. Yes, now you can not only annoy your close neighbors, but your entire community as well. Congratulations, you’re an ass.

Vrrooom — there goes your money

If annoying people with your racket is your thing, you still might want to rethink your choice of a Harley. If you’re choosing the two-wheel route for commuting reasons, there are better choices out there. Like any vehicle, you can always find a used one that’s already depreciated down to your comfort level, although a quick Google search makes it sound like there are maintenance issues with aging hogs (I’ll leave it to people who have owned them to confirm or deny that). Buying new is obviously foolish so we won’t even get into the price of new Harleys, although I also saw some complaining online about Harley flooding the market with cheap bikes, which is interesting.

Since Harley buyers purchased their rides for the noise and no other factor, it’s not surprising that things like fuel economy aren’t important at all. It shouldn’t be hard to find a bike that can get 60-70 mpg, which will help keep your commuting costs nice and low, but Harleys will be lucky to reliably get into the 50 mpg range. Now admittedly, that’s better than the 30ish you could expect from any sane car these days, but at least a car can be used for other things, giving you greater utility for your dollar.

Oh, and since you’re buying a machine strictly for image reasons, you’ll naturally want to be customizing that beast, right? Cha-ching again! Gotta have little leather saddlebags so people think you’re a legit Hell’s Angel member. Plus tassles and custom chrome pipes, right? Fancy spiral wheels, of course! And, naturally, you have to wear special little outfits so you can fit in with your fellow aging baby boomer bike riders (see below for more).

Harley riders live in fantasyland

My background is in marketing. One of the things we marketers always have to explain to nonmarketers is that branding isn’t the logo, the corporate colors, or the business processes. Those would be called branding elements. Your brand is the feeling that takes place inside your head. How you personally feel about McDonald’s is their brand to you, not the identifying golden arches. Big companies will spend big dollars putting statistics against how many people feel a certain way about a particular brand and then use advertising and strategic PR to reinforce or change those perceptions. You and your kids might have a completely different internal view of McDonald’s as well as a completely different reaction to the smell of their grease.

The Harley brand is all about how it makes riders feel about themselves. They throw a leg over the bike, rev up their obnoxious machine and imagine that all the world is in awe.

Have you ever had that experience at work where some condescending idiot is talking to you like YOU’RE the one who is dumb? If you’ve ever heard Sarah Palin talk you know what I’m talking about. That’s how I feel about Harley riders. If you happen upon a Harley rider in a parking lot and happen to look their way, you can almost read their mind. They’re sauntering toward their bike, soaking up your gaze, thinking “I’m a such a bad ass! I can feel that guy totally admiring me across the parking lot! I bet he’s super impressed by me. Maybe even scared of me. I am pretty tough. Yeah, me! Get yer motor runnnnnninnnn…“. Or something like that.

In reality, I’m thinking, “What a dork!” or “Isn’t that guy hot with all that leather on?” or “Wow, you can totally see that old guy’s tummy poking out of his vest.”

Because, let’s face it, Harleys are for old people. Nothing against old people, but is that really the look you’re going for? The last time I saw someone on a Harley look scary was probably 1978. And I think it was when I was watching CHiPs. (dooo-doo-do-do-doooo!)

Playing dress-up

Let’s all play dress-up!

And what is up with these little costumes that Harley riders are apparently required to wear? I assume it’s required because I’ve never seen a Harley rider not wearing one. The color-coordinated little outfits are like little toddler dress up costumes. Leather chaps, vests and jackets. Bandannas — branded of course — tied ever so carefully over the balding pate.

When not on duty, these people maintain their look, sporting branded T-shirts and belt buckles.

Every tribe has its identifying plumage. Street gangs famously line up by colors (or at least used to). White collar workers sip their lattes in their Dockers. People who pretend to be modern cowboys wear giant cowboy hats and big belt buckles as if they’re just about to head out to the range to brand a steer. But is there any other group that so identifies itself by pasting a corporate logo all over itself as the Harley rider? I struggle to think of anything even close. Perhaps the girls who have the word “Juicy” on the butt of their sweat pants come close, but even that seems like a much smaller group.

It’s easy to take on the trappings of any subculture that interests you these days. Everything has gotten so corporatized that you can buy the look that makes you feel like what you’ve always wanted to be. Only thing is, everyone knows you’re just a poser. People are spending massive amounts of money to appear to fit into one group or another. Sure you might be an overweight laid-off computer programmer, but with a few swipes of your credit card, you’re a BIKER!

Look, I get that people love to drop disposable income on things that make them feel better about themselves. Since people screw themselves out of their pretirement in so many different ways, it may be unfair to insist that above all other vehicles Harleys are dumb. But when your single-purpose vehicle drains your money, makes you look ridiculous and annoys everyone else, we need to agree that Harleys are the dumbest possible means of getting around.

I’m not here to tell anyone how to live their life. I’m just one voice suggesting that maybe there’s another way. If you want to blow your money on toys, go for it. But, maybe pick a toy that doesn’t ruin life for everyone else in the process.

So what do you think? Have I convinced you Harleys are dumb? Even the dumbest possible means of transportation?

Important post-script:

Harley-Davidson recently began showing off a prototype electric motorcycle. Should they actually begin selling these and displacing their nasty gas-powered inventory, I’ll take it all back. And I might even buy a Harley T-shirt.

Well, after three nights of trying to get Pretired Boy to sleep until 11 pm, this news is less bittersweet than sweet.

Well, after three nights of trying to get Pretired Boy to sleep until 11 pm, this news is less bittersweet than sweet.

Recent Comments