Today I’m kicking off a brand new feature on Pretired.org. It’ll be an occasionally recurring piece called “10 Questions For”. For the first one, I felt it only appropriate to feature the man who is basically my blogfather: Joe Udo of Retireby40.org. Joe’s blog is more than a detailed primer on how to escape the corporate treadmill, but is also an inspiring journey. Go back to his first post and read your way forward the way I did and you’ll be drawn in by his complete transparency and you’ll share his joy as he finally makes the move and quits his job. It’s a great blog and I recommend it to anyone considering pretirement. But I wanted to know more so I asked him 10 Questions.

How old were you when you decided to “Retire by 40”?

I think I was 36. Before that point, I was just planning to switch jobs or try to find a job at a different company.

I imagine there was a certain moment when you realized that you were throwing your life away working at a big corporation. Can you share that turning point?

It was a gradual process for me. I started getting some mysterious illnesses like dizziness and panic attacks when I was 35. The doctors never found anything conclusive, but I figured the stress was getting to me. I hated walking into work every day and that’s not a good way to live.

You figured out the path to financial independence earlier in life than most people in America. To what influences do you give credit for learning how to get there?

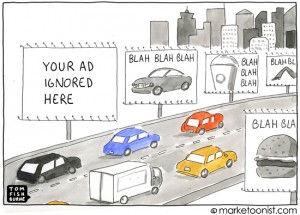

Actually, we’re not quite there yet. Mrs. RB40 is still working and that’s how she likes it. Our next target is to be able to function without her paycheck and save all of it. I think starting the Retire By 40 blog really helped me figure out how to quit my job. I had to research all the articles I wrote and the more I wrote, the more I learned. I was already reading a lot of personal finance articles, but writing my own blog was a big step toward financial independence.

You could have decided to “retire by 45” or “retire by 50”. You chose 40. Did you ever think about working a few more years to pad your retirement?

Not really. I already stayed at my old job longer than I wanted to. I figure if I couldn’t make it work, I could always go find another job. We also continue to save so our net worth is still increasing. We are not drawing-down yet so all-in-all we are doing fine.

It’s fairly unusual for the male in the relationship to be the one who stays home to raise the child. How did you and your wife decide you’d stay home? How does she feel about it?

She loves that I’m able to stay home with our kid. She knows she can’t be a stay at home mom because she likes to work and she is not the most patient person in the world. It’s not for every family, but it works well for us.

At what age does your wife plan to retire? What are her plans?

I think she’ll keep working until about 60 or so. She is restless and she likes being in the workforce. Perhaps she’ll cut down on the hours if we don’t need her salary anymore.

Your last day at your old job must have been amazing. What was that like?

It wasn’t dramatic because I wasn’t going in much in the last week. I worked from home and just took care of a few things. It felt great to drive away from the office for the last time, though.

Many, if not most, people are afraid to leave corporate life at such a relatively young age. What fears did you have before and do you have any worries now that you’re a stay-at-home dad?

Of course, I was afraid we wouldn’t be able to make the cash flow work. You can plan, but you never know how it’s going to turn out. Things are going really well, though, so I don’t worry much about the finance at this point.

Do you think everyone should try to retire by 40 or is it only for people who hate corporate life?

It’s more applicable to people who don’t enjoy their job anymore. However, you should still plan ahead even if you love your job/career. You probably won’t love it forever and it would be good to have an alternative plan.

What are your plans for when your son goes off to school? Obviously you’ll have a lot more time on your hands.

I’m still trying to figure it out. I would like to start some kind of micro business or just work more online. How about you? Do you have any plan for when your son starts school?

See folks, this is how nice of a guy Joe is! I’m asking him 10 Questions and he turns it around to find out more about me! But I’ll answer anyway: I’m not sure what I’ll do when Pretired Baby goes off to school. I’ll be 50 by that point so it’s going to be pretty hard to get a real job at that point, even if I wanted to find one. Ideally I’d have a little business of my own or maybe we’ll just do a lot of travel and sort of home-school him from the road. Short answer is I’m not sure yet, but it sure is nice to have options!

Thanks again, Joe! And for anyone who hasn’t already discovered Joe’s excellent blog, be sure to head over to Retireby40 right now!

I’m sure Joe will be stopping by at some point so feel free to say hello in the comments as well!